per capita tax reading pa

If you own your own home the Per Capita Tax is added. What is per capita tax calculation.

Alumni Association Wilson School District Berks County Pa

Taxes can be paid by check or money order.

. Unpaid Per Capita taxes are turned over to the G. This will give you tax revenue per capita in a given year. Divide the income tax revenue by the taxable population.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. West Reading PA 19611 For questions regarding your tax bill please contact the Deputy Tax Collector at 610 374-8273 ext. Harris Agency for collection.

City of Reading. Tax Rate for 2022 - Reading Pennsylvania 6 days ago Web Jul 01 2022 2022 City of Reading Taxes Tax Rates. Effective July 1 2022 the City of Readings non-resident commuter tax of 3 has been eliminated.

Non Resident EIT Rate Change Eff July 1 2022. Please call or email the Tax Collector Denice Carroll with any questions 610. All july 2022 per capita and real estate tax bills are due by december 31 2022.

The wilson school district tax office normal business hours of monday friday 730 am 400 pm. Per capita tax reading pa Thursday August 25 2022 Edit The City of Reading located in southeastern Pennsylvania is the principal city of the Greater Reading Area and the. Office hours vary and can be found on the.

The address is City Treasurers Office 449 West Main Street Monongahela PA 15063. ACT 679 Tax is. Current Year Taxes may be paid in either the Discount Face or Penalty period.

It can be levied by a municipality andor school district. The application form may be used by a PA taxpayer whose community has adopted one or. Face is the actual tax due which is the sum of any combination of Per Capita Act 511 Tax Per Capita Act 679.

1 week ago Nov 16 2021 Graph and download economic data for Per Capita Personal Income in Reading PA MSA. For most areas adult is defined as 18 years of age and older though in some. Reminder to pay your Per Capita tax bill before December 31st.

As of January 1 2017 the Tax Collector no longer accepts cash. Kristi Piersol is the Townships elected Tax Collector and is responsible for collecting Real Estate Taxes and Per Capita Taxes. The Per Capita Tax rate is 1000 ten dollars.

Access Keystones e-Pay to get started. Per Capita Personal Income in Reading PA MSA. ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000.

If both do so it is shared 5050. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Click here for more information.

Per capita exemption requests can be submitted online. Check your current bill for more information. For most areas adult is defined as 18 years of age and older though in.

The Tax Collectors office is located at the Boroughs. Copy and paste this code into your website.

West Reading Pennsylvania Pa 19611 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Real Estate And Per Capita Tax Wilson School District Berks County Pa

West Reading Pennsylvania Pa 19611 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

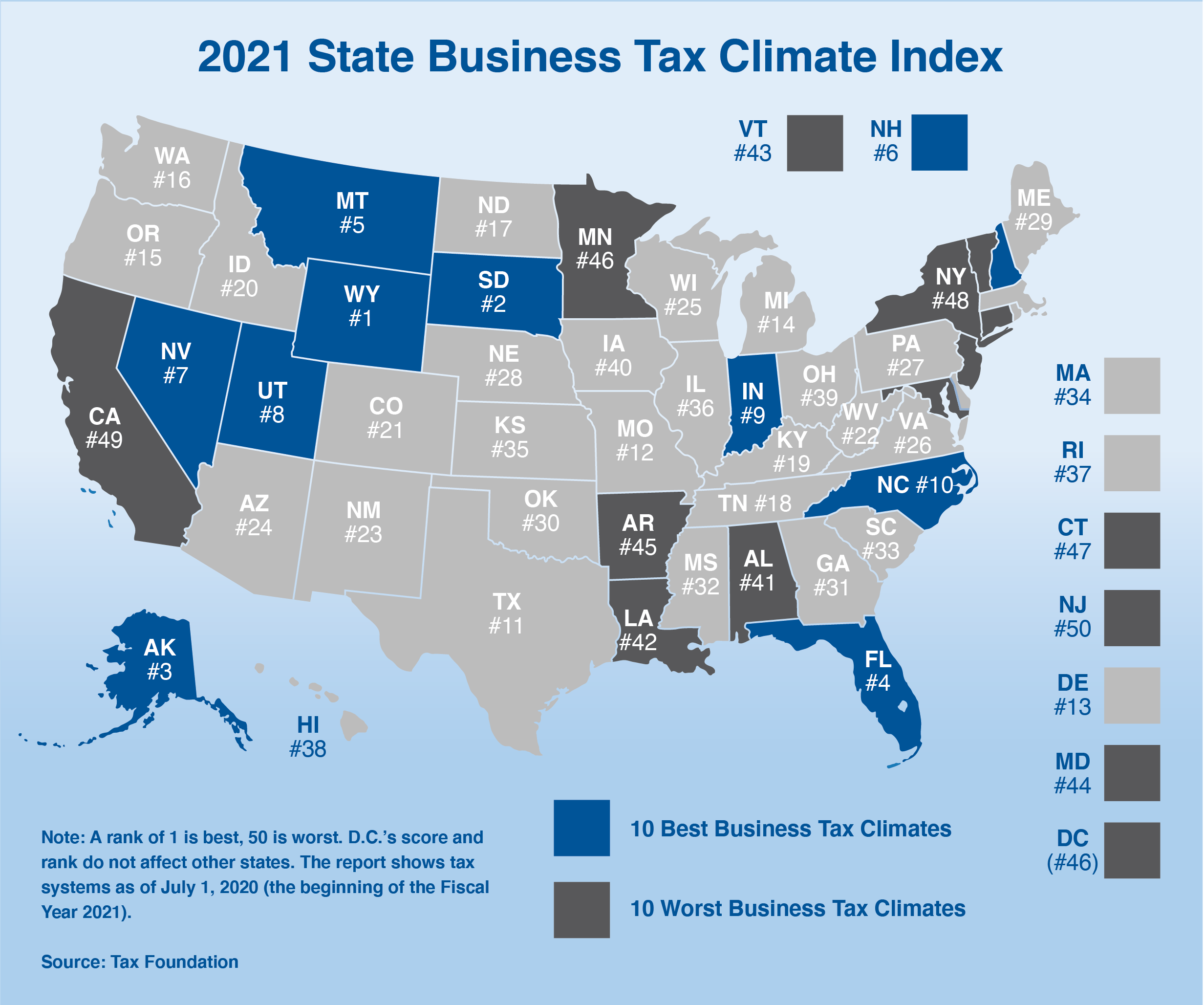

Altered State A Checklist For Change In New York State Empire Center For Public Policy

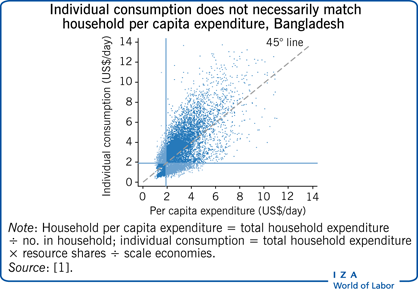

Iza World Of Labor Measuring Poverty Within The Household

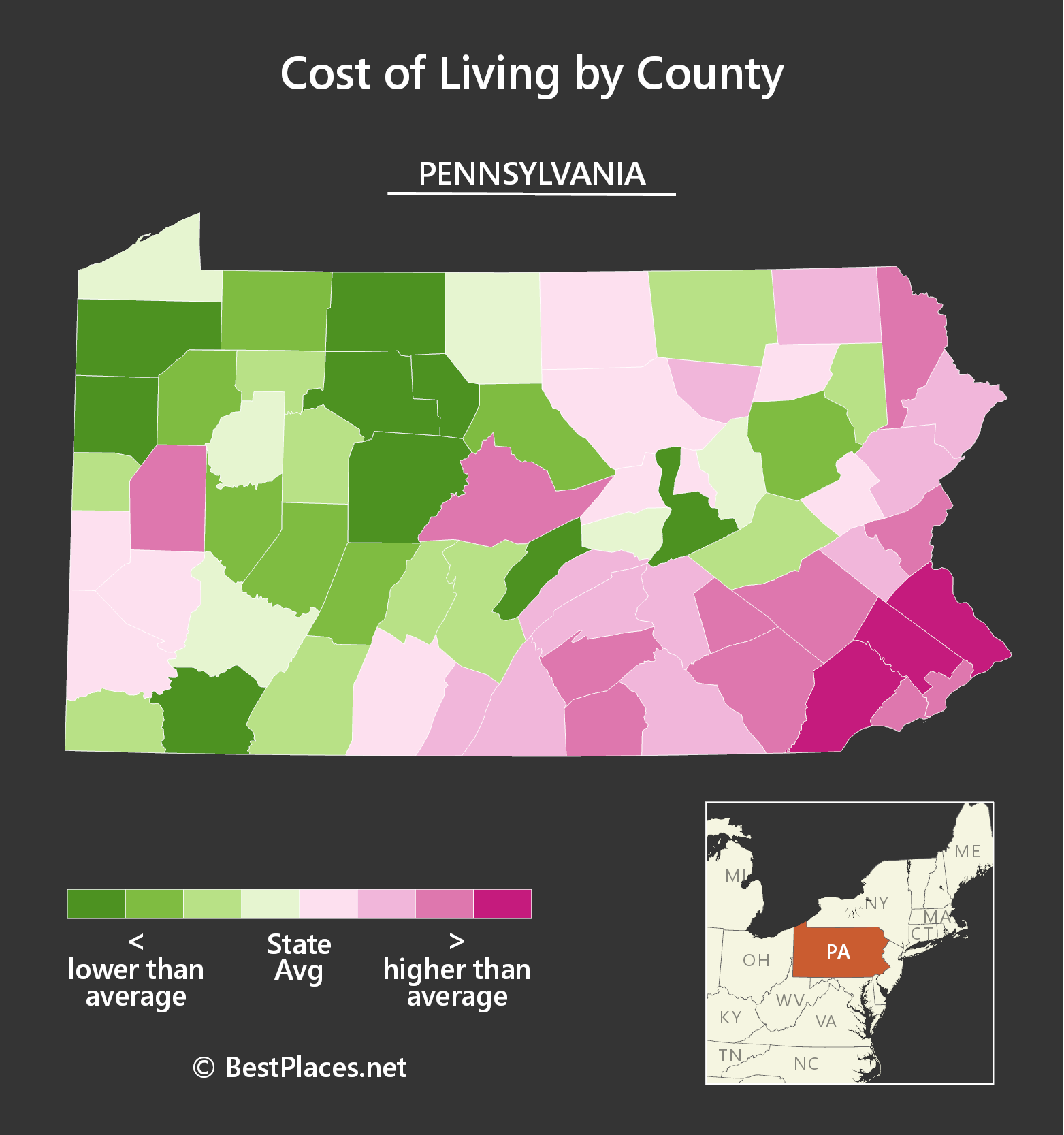

What Would No Property Taxes In Pa Mean For School Districts Taxpayers Publicsource

Are Taxes Cheaper In Maryland Or Virginia Quora

What Would No Property Taxes In Pa Mean For School Districts Taxpayers Publicsource

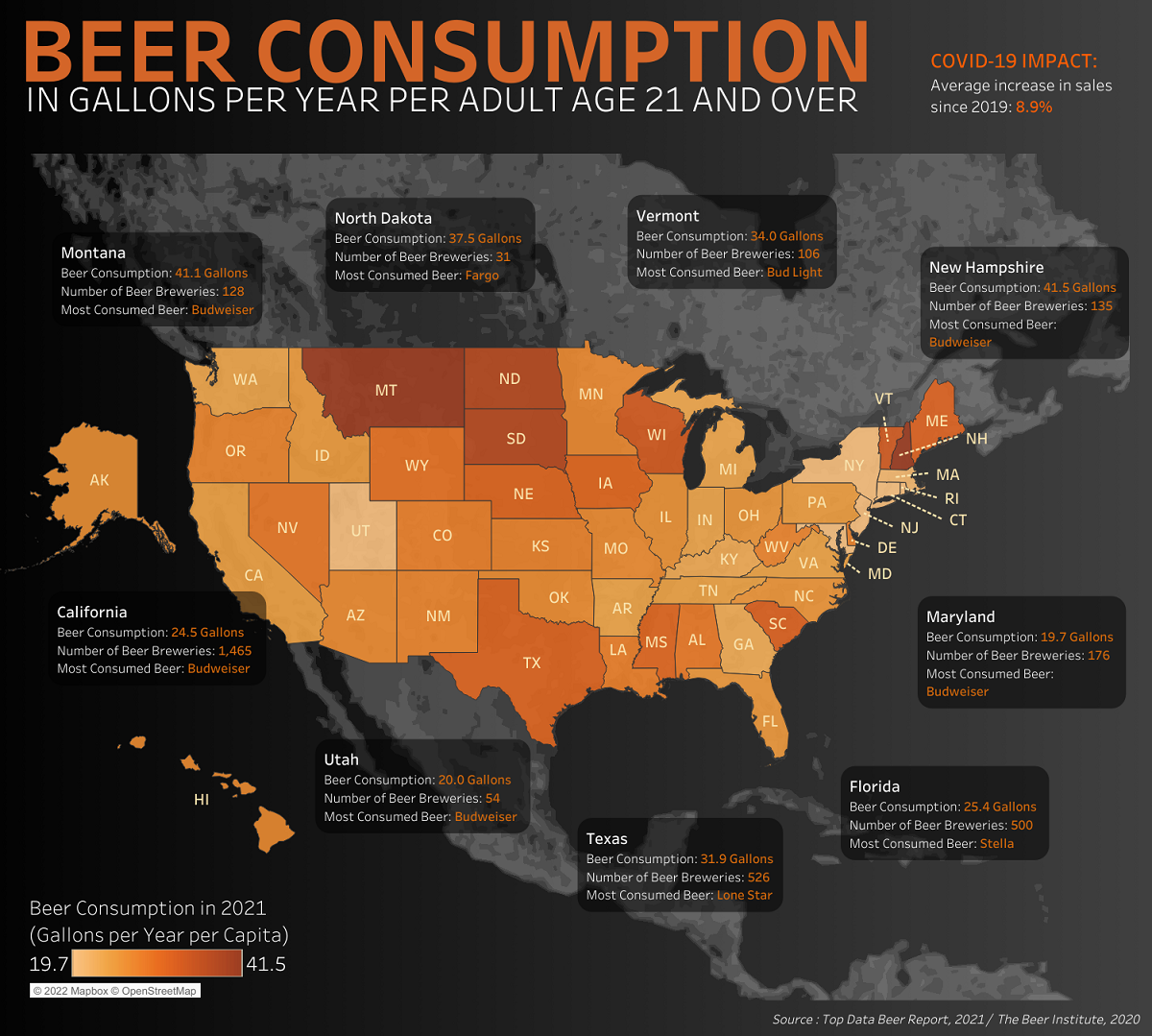

Mapped Beer Consumption In The U S

Per Capita Personal Income In Reading Pa Msa Read742pcpi Fred St Louis Fed

Best Places To Live In Reading Pennsylvania

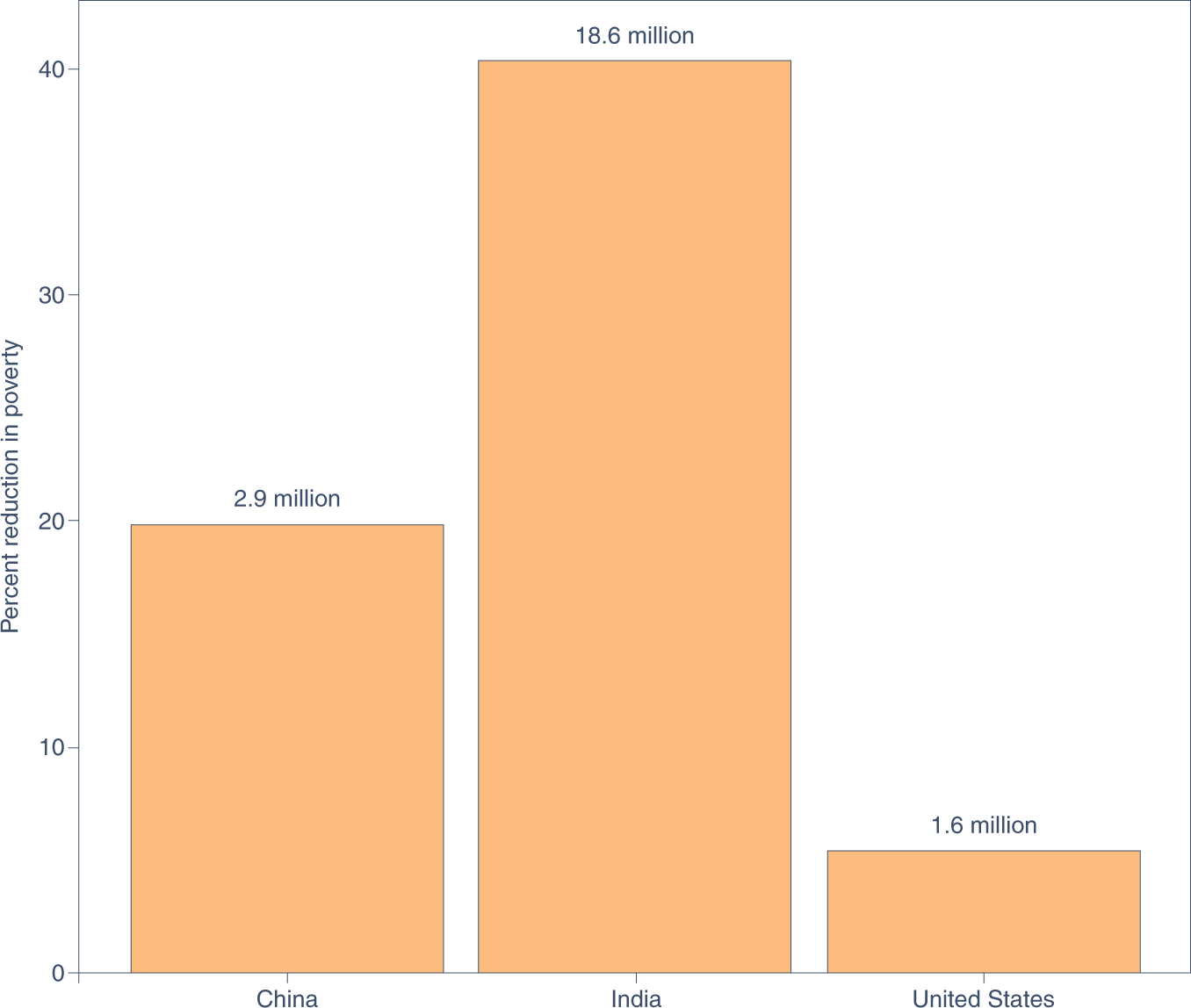

Protecting The Poor With A Carbon Tax And Equal Per Capita Dividend Nature Climate Change